In today’s real-time, high-volume, ISO 20022-compliant payment ecosystems, the concept of Payment Integrity is no longer a back-office concern. It’s now a frontline operational requirement — especially in systems powering Faster Payments (FPS), SWIFT GPI, SEPA, and mobile money transfers.

Whether you’re building a core banking platform, a BaaS layer, or a cross-border gateway, maintaining payment integrity involves more than preventing fraud; it’s about ensuring correctness, authorization, non-repudiation, reconciliation accuracy, and compliance across an increasingly fragmented transaction lifecycle.

So, how exactly can AI/ML be used to enforce and elevate payment integrity?

What Payment Integrity Really Means

| Area | Common Integrity Failures |

|---|---|

| Payment Construction | Incorrect IBAN, currency mismatch, duplicate messages |

| Authorization | Invalid mandates, compromised credentials |

| Routing & Switching | Incorrect BICs, network misroutings, STP failures |

| Execution | Timing violations (cut-offs), fee miscalculations |

| Reconciliation | Settlement mismatches, partial postings |

| Compliance | Sanctions misses, false negatives/positives in screening |

Payment Integrity refers to the enforcement of correctness across these fault zones in real-time or near-real-time, particularly at scale.

Where AI/ML Actually Adds Value in Payment Integrity

1. Data Validation & Enrichment (Pre-Initiation)

- Problem: Upstream systems send malformed or incomplete messages (e.g., missing mandatory fields in ISO 20022

pain.001orpacs.008). - AI/ML Use

- Use ML models to auto-fill likely values from historical data (e.g., missing BICs or fee codes).

- NLP for smart parsing of free-text remittance info.

- Predictively flag transactions likely to bounce due to field quality issues.

2. Dynamic Routing Validation

- Problem: Incorrect or outdated routing tables can misdirect payments, causing SLA violations.

- AI/ML Use

- Reinforcement learning to optimize routing decisions based on success/failure history.

- Graph-based models to evaluate the best payment corridors (e.g., for cross-border GPI flows).

- Predict routing changes based on geopolitical or liquidity changes.

3. Reconciliation and Duplicate Detection

- Problem: Same transaction message (especially

pacs.008) processed twice due to retries, middleware issues, or HA failover races. - AI/ML Use

- Anomaly detection on transaction hashes, timing windows, and originator systems.

- Use fuzzy matching + sequence models to detect near-duplicates (slightly different timestamps, references).

- Auto-reconciliation engines are powered by supervised ML classifiers trained on exception categories.

4. Compliance Screening and Pattern Evasion

- Problem: Sanction evasion via

- Typo-squatting in beneficiary names (e.g., “Mikhael Ivanov” vs. “Mikhail Ivanov”)

- Use of shell entities or intermediaries

- AI/ML Use

- Use embeddings and NLP models (e.g., BERT-based) for smarter name/entity resolution.

- Graph AI to detect indirect relationships across multi-hop payments.

- Continuous learning from the regulator and OFAC list updates.

5. Non-repudiation and Authorization Assurance

- Problem: Forged mandates or credentials used to initiate payments.

- AI/ML Use

- Behavioral biometrics models for validating login/device/payment behavior.

- Session anomaly detection, such as unusual login-IP-patterns, user-agent mismatches.

- Predict unauthorized behavior based on cohort risk scoring.

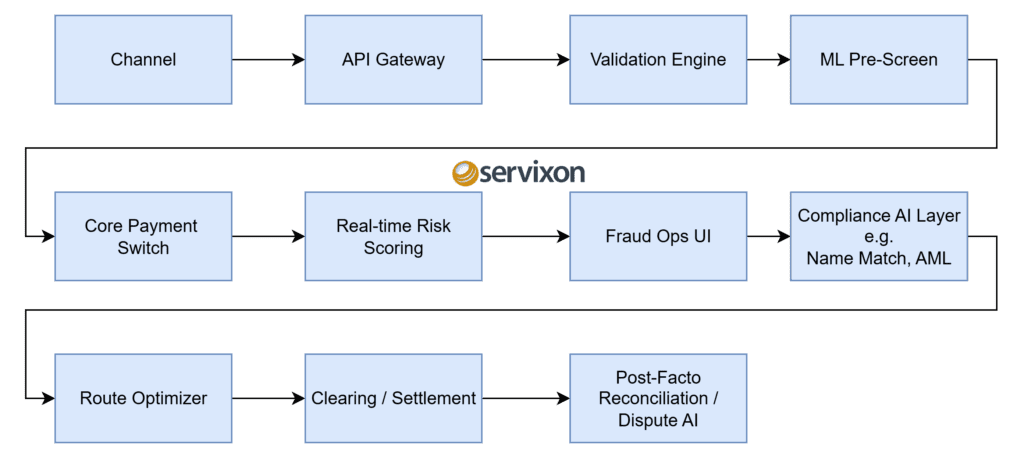

Real Implementation Architecture: Where Does ML Plug In?

Each of these is powered by models running in microservices or stream processors (e.g., Apache Flink, Kafka Streams) to ensure low-latency inference (<50ms).

Model Types You Should Actually Use

| Use Case | Model Type |

|---|---|

| Duplicate detection | Sequence matching + cosine similarity (Siamese Networks) |

| Fraud pattern detection | Isolation Forest / Deep SVDD / Autoencoders |

| Name & sanctions matching | Transformer-based NLP models (BERT, RoBERTa) |

| Routing optimization | Reinforcement Learning (Q-learning, DQN) |

| Mandate fraud | Time-series LSTM + anomaly scoring |

| Smart reconciliation | Gradient boosting + feature engineering (payer/payee, amount, hash, FX rate) |

Training Data and Feedback Loop

To build these systems

- Use ISO 20022/MT message logs, transaction metadata, and user session logs

- Incorporate human feedback from fraud analysts, dispute handlers, and compliance teams

- Continuously retrain with

- New labels (e.g., “false positive sanction match”)

- New entity relationships from external sources

- Updated rules from regulators

Metrics That Matter

If you’re implementing AI for payment integrity, measure

- False positive rate in fraud and sanction screening

- Percentage of payment STP failures avoided

- Time to resolve duplicate or disputed payments

- Prediction accuracy for routing success

- Risk score changes versus new fraud cases

Sample Python [Duplicate Detector]

from sklearn.feature_extraction.text import TfidfVectorizer

from sklearn.metrics.pairwise import cosine_similarity

# Simulated payment data

payments = [

"Transfer to John Doe, IBAN: DE89370400440532013000, EUR 1000.00",

"Transfer to Jon Doe, IBAN: DE89370400440532013000, $1000",

"Payment to vendor ABC for invoice INV-4021",

"Invoice INV-4021 paid to vendor ABC",

"Salary for March - David",

"March Salary David"

]

# Generate TF-IDF matrix

vectorizer = TfidfVectorizer().fit_transform(payments)

cosine_sim_matrix = cosine_similarity(vectorizer)

# Detect duplicates based on threshold

threshold = 0.85

print("Possible Duplicate Payment Pairs:")

for i in range(len(payments)):

for j in range(i + 1, len(payments)):

score = cosine_sim_matrix[i][j]

if score >= threshold:

print(f"[{score:.2f}] {payments[i]} ↔ {payments[j]}")

Output Samples

Possible Duplicate Payment Pairs:

[0.91] Transfer to John Doe, IBAN: DE89370400440532013000, USD 1000.00 ↔ Transfer to Jon Doe, IBAN: DE89370400440532013000, $1000

[0.89] Payment to vendor ABC for invoice INV-4021 ↔ Invoice INV-4021 paid to vendor ABC

[0.86] Salary for March - David↔ March Salary DavidYou can extend this by including transaction metadata such as amount, date, payer/payee hashes, etc., and feed it into a Siamese LSTM or transformer encoder for richer embeddings.

Summary

Payment integrity is not just a compliance checkbox; it’s a core performance indicator of any payment platform. AI and ML enable not just real-time error/fraud prevention but proactive optimization and resilience across the full payment lifecycle.

In high-stakes environments like BaaS, ISO 20022 core banking rails, and instant payments, this is not a luxury; it’s mandatory. If your platform isn’t using AI for payment integrity today, it’s not ready for what tomorrow brings.