This blog highlights some common information security standarads which are being used in the industry to secure the information systems. Different system has different security requirements, but general ISO 27001 information security standards would be the good start if you are looking to build your information security practice.

ISO 27001 is a widely recognised international standard for information security management systems (ISMS). It provides a framework for organizations to establish, implement, maintain, and continually improve their information security practices. Implementing ISO 27001 can be particularly important for the banking industry, where the confidentiality, integrity, and availability of sensitive customer information and financial data are critical.

SOC 2 (System and Organization Controls 2) is a widely recognized auditing standard developed by the American Institute of CPAs (AICPA). While SOC 2 is not specific to the any industry, it can be highly relevant and beneficial for banks and other financial institutions that handle sensitive customer information. SOC 2 focuses on the security, availability, processing integrity, confidentiality, and privacy of customer data.

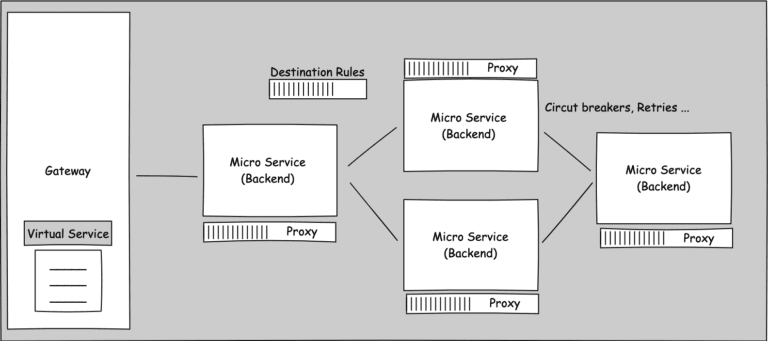

CSA, which stands for Cloud Security Alliance, is an organization dedicated to promoting best practices and security standards in cloud computing. While CSA itself is not specific to any industry, its guidance and frameworks can be highly relevant for banks and financial institutions as they adopt cloud technology. The CSA provides various resources and initiatives to help organizations, including those in the banking sector, address cloud security challenges.

CAIQ, which stands for Consensus Assessments Initiative Questionnaire, is a comprehensive set of questions developed by the Cloud Security Alliance (CSA) to assess the security capabilities of cloud service providers (CSPs). While CAIQ itself is not specific to any industry, it can be highly relevant for banks and financial institutions as they evaluate and select CSPs for their cloud-based services. The CAIQ helps banks and other financial institutions assess the security posture of CSPs and ensure they meet the required security standards.

CCM, which stands for Cloud Controls Matrix, is a comprehensive framework developed by the Cloud Security Alliance (CSA). While CCM itself is not specific to any industry, it provides a structured and standardized set of controls and requirements that can be highly relevant for banks and financial institutions as they evaluate and assess the security of cloud service providers (CSPs). The CCM can help banks and other financial institutions to understand the security controls and practices of CSPs and ensure they meet the necessary standards e.g. STAR Certification provides independent assurance that a CSP meets specific requirements outlined in the CCM.

PCI DSS, Payment Card Industry Data Security Standard is a security standard specifically designed for organizations that handle credit card information. It outlines security requirements to protect cardholder data, including secure network configurations, encryption, access controls, vulnerability management, and regular security assessments.

FFIEC, Federal Financial Institutions Examination Council IT Examination Handbook provides guidance for financial institutions to assess and manage risks associated with technology and information systems. It covers various areas, including IT governance, cybersecurity, business continuity planning, cloud computing, and vendor management.

NIST, National Institute of Standards and Technology (NIST) Cybersecurity Framework is a widely adopted framework that provides a risk-based approach to managing cybersecurity risks. It helps organizations identify, protect, detect, respond to, and recover from cyber threats. The framework provides guidance on managing cybersecurity risks in the context of people, processes, and technology.

GDPR – EU Specific, General Data Protection Regulation is not specific to financial services, it is a crucial regulation for organizations handling personal data, including financial data. GDPR outlines requirements for the protection of personal data and grants individuals control over their data. Financial institutions must ensure compliance with GDPR when processing personal data in the cloud.

FedRAMP- US Specific, Federal Risk and Authorization Management Program provides a standardized approach to security assessment, authorization, and continuous monitoring of cloud products and services. It is particularly relevant for financial institutions that handle government data or work with federal agencies in the United States.