Introduction

Artificial Intelligence (AI) has emerged as a driver for industry-wide transformation in the rapidly expanding technology world. This change is also being led by the banking industry. AI technology have already disrupted traditional banking practices, ushering in a new era of efficiency, personalization, and innovation. Among the different AI subfields, generative AI has emerged as an especially powerful tool, transforming how banks engage with clients, manage risks, and make strategic decisions.

Generative AI, a subclass of AI that focuses on creating new contents, visuals, and even ideas, is pushing the envelope in the banking industry. This technology’s potential to generate unique data and insights is altering financial institutions’ operations, ranging from customized client experiences and fraud detection to risk assessment and investment strategies. As generative AI’s capabilities increase, it is critical for the financial industry to understand both its potential benefits and difficulties.

In this blog post, we will delve into the profound impact of generative AI on the banking sector. We will explore its applications across various aspects of banking operations and specifically in revolutionizing customer experiences.

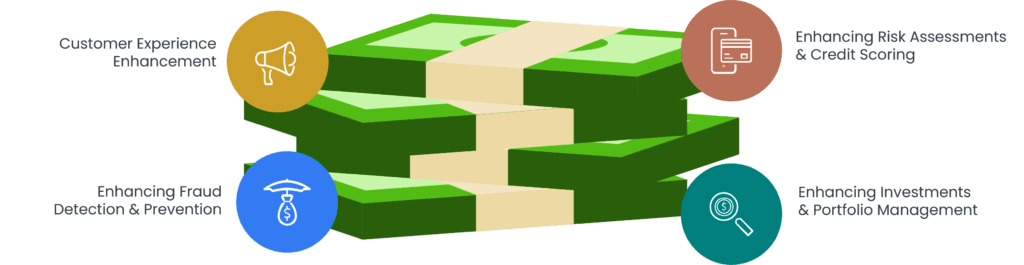

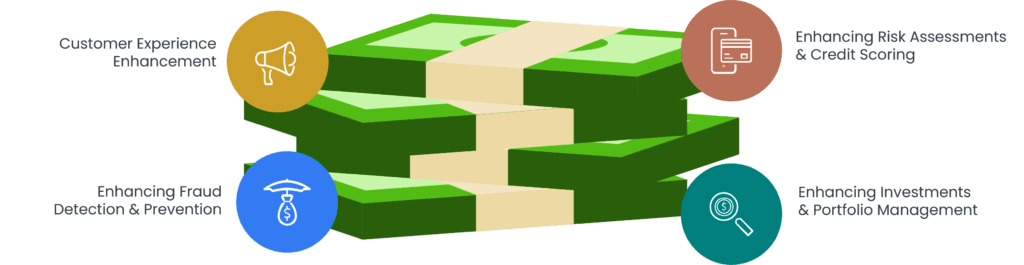

Generative AI use cases in banking

Customer Experience Enhancement

In a variety of industries, including banking, generative AI is altering consumer experiences. It was previously difficult to achieve such a level of personalization, engagement, and ease. For a variety of reasons, generative AI is critical in the context of Customer Experience Enhancement in the banking business.

Personalized Interactions

Generative AI enables institutions to customize interactions to individual customers’ interests and habits. Generative models can provide customized messages, offers, and recommendations based on client data, promoting a sense of consumer gratitude.

Hyper Personalized Services

In addition to simple interactions, generative AI can provide hyper-personalized services. Banks, for example, can create investment portfolios that match with a client’s financial objectives, risk tolerance, and market conditions. This level of personalization improves the customer’s experience with the bank’s services.

24/7 Availability

AI-powered virtual assistants, chatbots, and automated customer support representatives can be accessed 24 hours a day, seven days a week. This ensures that customers may get help, get answers to their problems, and make transactions at any time, increasing ease and access.

Better User Experienced Onboarding

Generative AI can streamline the customer onboarding process by creating customized welcome messages, offering step-by-step advice on account opening, and even repeating the user’s first experiences with the bank’s services.

Natural Language Understanding and Interpretation

Chatbots and virtual assistants powered by Generative AI are getting better at understanding and responding to natural language. Interactions become more intuitive and human-like as a result, lowering consumer dissatisfaction and improving their entire experience.

Fast Issue Resolution

AI with generative capabilities can help with problem solving and troubleshooting by creating relevant solutions and instructions. This speeds up problem resolution and decreases the amount of time clients spend looking for help.

Reduce Customer Friction

Consumers may access banking services more easily with AI-powered interfaces. Generative AI can recommend the best appropriate products while also guiding users through complex processes and eliminating typical pain points throughout the user experience.

Enhanced Customer Engagement

Using generative AI, banks can engage customers with material that speaks to them. This might include AI-generated financial advice, market data, and educational content that empowers people to make sound financial decisions.

Predictive Personalization

Generative AI may predict customer requirements and preferences based on historical interactions and behaviors. This enables banks to provide relevant solutions in advance, building anticipation and meeting clients’ expectations before they express them.

Continuous Improvement

Generative AI systems can learn from each interaction and evolve over time. This iterative learning process allows AI systems to enhance their responses, ideas, and recommendations, leading in more accurate and value consumer interactions.

Scalability

As client bases grow, generative AI systems can handle a high amount of interactions while maintaining quality. Because of its scalability, each customer receives prompt attention and assistance.

Incorporating generative AI into customer experience initiatives allows banks to create personalized, convenient, and meaningful interactions that foster client loyalty and happiness. . As customers increasingly expect personalized and seamless experiences, generative AI is becoming an essential tool for banks looking to stay competitive in today’s market.